Noble Apex News

As the hype around artificial intelligence (AI) grows, investors are asking whether the introduction of generative AI technologies signals the start of the next transformational cycle in markets, or whether we are simply seeing the continuation—or perhaps culmination—of the information technology cycle that started in the late 1970s.

Equity market volatility is likely to remain elevated over the coming months given a high degree of economic uncertainty relating to US trade policy. In the current environment, a tilt towards income payers in equity portfolios not only provides dividend income, but can also help to shield against the risk of a further valuation rerating.

Amid elevated policy uncertainty and market volatility, some investors might conclude that hiding in cash is a sensible strategy for the next 12 to 18 months. After all, deposit rates remain relatively high across Western markets, and the macroeconomic picture is murky. However, in our view cash will not prove the best option for investors. Whether the global economy continues to expand or falls into a downturn or recession, we expect cash to underperform other asset classes. Even in a stagflationary scenario, investors can look elsewhere for meaningful portfolio diversification.

With the return of inflation and spiraling levels of government debt, many investors are questioning whether bonds will still provide a life-raft in times of market turbulence. And if not, how should one construct a diversified, balanced portfolio?

How does incorporating information on environmental, social, and governance (ESG) risks affect the performance of a portfolio? Does considering these issues put a portfolio on a better footing to cope with a changing world and enhance returns? And what about aligning values with investment decisions? In this piece, we look at this complex issue by investigating past data and discussing its limitations, particularly in predicting future performance. We also consider whether changing consumer preferences and evolving regulatory and policy initiatives to tackle ESG issues might mean that investors who are ahead of the change might be expected to see portfolio benefits.

Wider valuation and performance dispersion, elevated market concentration and potentially higher-for-longer interest rates underscore the importance of an active approach to engage opportunities and manage risks in the global stock markets.

While the path to policy easing or rate cuts in 2024 could be bumpy, it still presents a constructive backdrop for fixed income. Moreover, with starting yields across many fixed income sectors hovering near decade highs, it could be opportune to lock in elevated yields as central banks approach the end of their rate hike cycles.

Asia assets should stay relatively resilient as Asian economies offer a larger growth alpha and lower inflation when compared with developed markets. Price action across Asia credit suggests light positioning and a generally cautious attitude towards the Asia credit market. The reason for caution is not related to the macro conditions or credit fundamentals within Asia but rather the lingering uncertainties on the global macro outlook. Hence clarity on the macro front will help increase conviction amongst Asian assets investors to add risk. Asian economies are experiencing growth tailwinds, Asian central banks are nearing the end of rate hike cycles and Asian currencies are strengthening, limiting the downside risks.

Rising hopes of a Goldilocks scenario have been supportive for stocks this year. The strong rebound since last September’s market trough has been almost entirely driven by multiple expansion. The rally has been fuelled by a combination of rising valuations and improved earnings expectations as the risks of an energy supply crunch have faded. An economic downturn still seems the most likely scenario to rid developed economies of their inflation excesses. But lower inflation, by definition, means lower corporate pricing power.

Investment markets are off to a good start. China’s reopening, moderating US inflation and firming expectations of smaller interest rate hikes by the Federal Reserve have seemingly prompted a turn in market sentiment. Among investors, some may be considering the prospect of dialing up risk in portfolios to make the most of the recovering market sentiment. Yet there are risks ahead. Aggressive monetary policy tightening has increased the risks of a downturn in the US, while China may be facing some challenges in the transition towards living with COVID-19. Elevated economic uncertainty may keep markets volatile for some time.

For much of the past decade, the ability of bonds to offer either of these was steadily diminishing. A long bull market compressed yields to record low levels, forcing investors to make an unenviable choice: accept paltry returns by investing in government bonds at ever lower yields, or chase higher yields in lower quality parts of the fixed income universe and take on much more risk as a result?

Some people may want to keep as much cash on hand as possible as they believe there won’t be a steady stream of income for life in retirement. The likely erosion of capital amid market volatility could also cause them to shy away from risk assets. While this may ring true for some people, the return on cash is relatively low and may be insufficient to support a life in retirement if they do not work harder to build their wealth.

Planning and investing for retirement can sometimes seem overwhelming, but it doesn’t need to. A simple process, which we refer to as goals-based investing, can help you every step along the way.

While on a hike, a hiker can take various routes but changing weather conditions could sometimes have an impact on the journey. It is similar to searching for income opportunities where amid periods of heightened market volatility, investors, based on their financial objectives and risk appetite, could adjust the allocation of fixed income, equity or other hybrid assets in a diversified portfolio to help manage risk. Just as a hiker would select the route or a combination of routes, according to stamina, objectives of the journey and weather conditions, we share some of our top convictions as we seek out multi-asset income opportunities in changing markets. Even amid heightened market volatility due to the conflict in Ukraine, we believe that income still has a key role to play in an overall portfolio.

It is customary in Hong Kong and Singapore to serve ‘Pun Choi’, or a prosperity pot, when families and friends gather to celebrate the Lunar New Year. The dish comprises multiple layers of seafood, meats and vegetables, and is slow-cooked over time. And like a ‘prosperity pot’, investors, depending on their investment objectives and risk appetite, could consider a wider variety of income sources in an investment portfolio. Seeking diversification in a portfolio for robust income potential has become increasingly important especially as the Fed is expected to raise interest rates this year and the military conflict between Russia and Ukraine may continue to affect the market for a long time.

Sports has been in the limelight in recent months. By taking cues from elite athletes in their training programmes, investors could consider adopting a perseverant and consistent approach when they map out their long-term investing strategy. A Hong Kong fencing medalist was reported to have said that being a champion is not just a dream, but one has to work hard and not give up. This could be likened to keeping your financial goals in-check, investing regularly and staying invested.

For most people in Hong Kong, a question that comes to mind about retirement is “do I have enough money to retire?”. Findings from a recent J.P. Morgan Asset Management survey revealed that people of different generations have varying levels of expectations. Millennials have set lower savings target for retirement compared with older adults. As of October 2019, Hong Kong people aged 30 to 40 estimated that they could retire by the age of 61, on average, and thought HK$3.6 million would be sufficient. In contrast, those aged 51 to 60 expected that they could retire at 64, and need HK$4.3 million - a difference of HK$700,000.

Big decisions such as college education, career progression, marriage, buying a home and raising a family all need financial support. And most people work hard to accumulate the wealth needed to help achieve their life goals. Generally, there are no hard and fast rules when it comes to investing. Some investors may study the most complex and deepest theories to gain insights into market trends, and seek potential opportunities for greater returns. Others could keep faith with a number of fundamental investing principles and strategies to help them achieve their financial goals.

Health care is one of the biggest expenses in retirement and the toughest to budget. How long will you live? What kind of care will you need? Where will prices be decades from now? If your insurance can’t cover everything, how much will you need to fork out of your own pocket? Even though engaging in healthy behaviors may keep our average costs lower over time, we cannot know what medical issues we may confront or how long we will live. A survey found that 76% of respondents were worried that health care costs in retirement will put a big strain on their retirement savings.

We are pleased to announce Noble Apex Wealth Ltd become one of Associate Firm of the Chartered Insurance Institute. The Chartered Insurance Institute is a professional body dedicated to building public trust in the insurance and financial planning profession. Through relevant learning, insightful leadership and an engaged membership to drive forward professional standards.

We are honored to be recognized by the Chartered Insurance Institute for our profession in the insurance industry. We will continue to provide a personalized "one-stop" financial and investment service with our expertise; We care for clients’ needs and provides comprehensive financial planning solutions and products to the best interest of our clients for their financial freedom.

Asian governments are taking steps to help cushion the financial impact of the pandemic. Some—like Australia and Malaysia—are lessening penalties for withdrawals of retirement assets and/or reducing mandatory contributions. The Hong Kong and Singapore governments are under pressure to allow withdrawals but are providing cash payouts and subsidies instead.

For the first time in history, the Earth hosts more people aged over 60 than under five. Today, people in many countries can expect to live into their sixties or longer. Older people can pursue new activities in education, work or their hobbies. Yet having the freedom to do so depends on two things – health and finance.

A survey found that only 43% of the Hong Kong investors have made detailed plans about their retirement despite 71% of the respondents think they need to start investing early for retirement. In school, your children would need a lesson plan and do their homework to stay on track to achieve an A+. Similarly, it is equally important for you to have a plan to stay on track to achieve your retirement goals. When it comes to retirement planning, the mantra is ‘the earlier the better’.

Life is tough for an income-seeking investor today. A decade of easy monetary policy has pushed cash and short-dated government bond rates down to levels where they now offer little to nothing in terms of income. In some countries, negative rates are nibbling away at savings held on deposit.

Noble Apex contributes to the community actively, for example, in promoting appropriate financial education in the community and improving public financial management awareness. In order to further contribute to our society, we have established Noble Apex Charity Fund and the Noble Apex Charity Ambassadors team. The Charity Fund is aimed to provide useful financial knowledge to the public, hence improving the quality of life; and to offer voluntary services as per request and cooperate with non-profit organizations to provide people in need with necessary resources.

This year, Noble Apex has been awarded Financial Education Leadership Awards 2020 organized by The institute of Financial Planners of Hong Kong ( IFPHK ). The Awards are - Award for Corporate financial Education Leadership – Gold and Award for Corporate Volunteer Team in Financial Education - Gold. This bears witness to our contribution to the society and affirmed our achievements for promoting financial education in the community. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society, now and in the future.

Noble Apex contributes to the community actively, for example, in promoting appropriate financial education in the community and improving public financial management awareness. This year, Noble Apex has been awarded Financial Education Champion 2020 organized by Investor Education Centre. This bears witness to our contribution to the society and affirmed our achievements for promoting financial education in the community. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society, now and in the future.

We are pleased to announce Noble Apex Wealth Ltd. was conferred the honor of " Caring Company" by The Hong Kong Council of Social Services (HKCSS). The Caring Company Scheme aims at building a cohesive society by promoting strategic partnership among businesses and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment.

The recognition ceremony took place at Hong Kong Convention and Exhibition Centre on 20 May 2019. This honor is the recognition of our commitment in Volunteering, Giving, Mentoring, Employing the Vulnerable, Caring for the Employees and Caring for the Environment for the past year. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society in the future.

Accredited two Financial Education Awards 2019

Noble Apex contributes to the community actively, for example, in promoting appropriate financial education in the community and improving public financial management awareness. In order to further contribute to our society, we have established Noble Apex Charity Fund and the Noble Apex Charity Ambassadors team. The Charity Fund is aimed to provide useful financial knowledge to the public, hence improving the quality of life; and to offer voluntary services as per request and cooperate with non-profit organizations to provide people in need with necessary resources.

This year, Noble Apex has been awarded Financial Education Leadership Awards 2019 organized by The institute of Financial Planners of Hong Kong ( IFPHK ). The Awards are - Award for Corporate financial Education Leadership – Gold and Award for Corporate Volunteer Team in Financial Education - Gold. This bears witness to our contribution to the society and affirmed our achievements for promoting financial education in the community. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society, now and in the future.

Noble Apex contributes to the community actively, for example, in promoting appropriate financial education in the community and improving public financial management awareness. This year, Noble Apex has been awarded Financial Education Champion 2019 organized by Investor Education Centre. This bears witness to our contribution to the society and affirmed our achievements for promoting financial education in the community. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society, now and in the future.

We are pleased to announce Noble Apex Advisors Ltd. was conferred the honor of "15 Years Plus Caring Company" by The Hong Kong Council of Social Services (HKCSS). The Caring Company Scheme aims at building a cohesive society by promoting strategic partnership among businesses and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment.

The recognition ceremony took place at Hong Kong Convention and Exhibition Centre on 16 Mar 2018. This honor is the recognition of our commitment in Volunteering, Giving, Mentoring, Employing the Vulnerable, Caring for the Employees and Caring for the Environment for the past 16 years. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society in the future.

Accredited two Financial Education Awards

Noble Apex contributes to the community actively, for example, in promoting appropriate financial education in the community and improving public financial management awareness. In order to further contribute to our society, we have established Noble Apex Charity Fund and the Noble Apex Charity Ambassadors team. The Charity Fund is aimed to provide useful financial knowledge to the public, hence improving the quality of life; and to offer voluntary services as per request and cooperate with non-profit organizations to provide people in need with necessary resources.

This year, Noble Apex has been awarded Financial Education Leadership Awards 2018 organized by The institute of Financial Planners of Hong Kong ( IFPHK ). The Awards are - Award for Corporate financial Education Leadership – Gold and Award for Corporate Volunteer Team in Financial Education - Gold. This bears witness to our contribution to the society and affirmed our achievements for promoting financial education in the community. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society, now and in the future.

The Award presentation ceremony took place at The Conrad Hong Kong on 19 January 2018. IFPHK presented several great awards to the outstanding enterprises and affirmed our contribution of the public financial education. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society in the future.

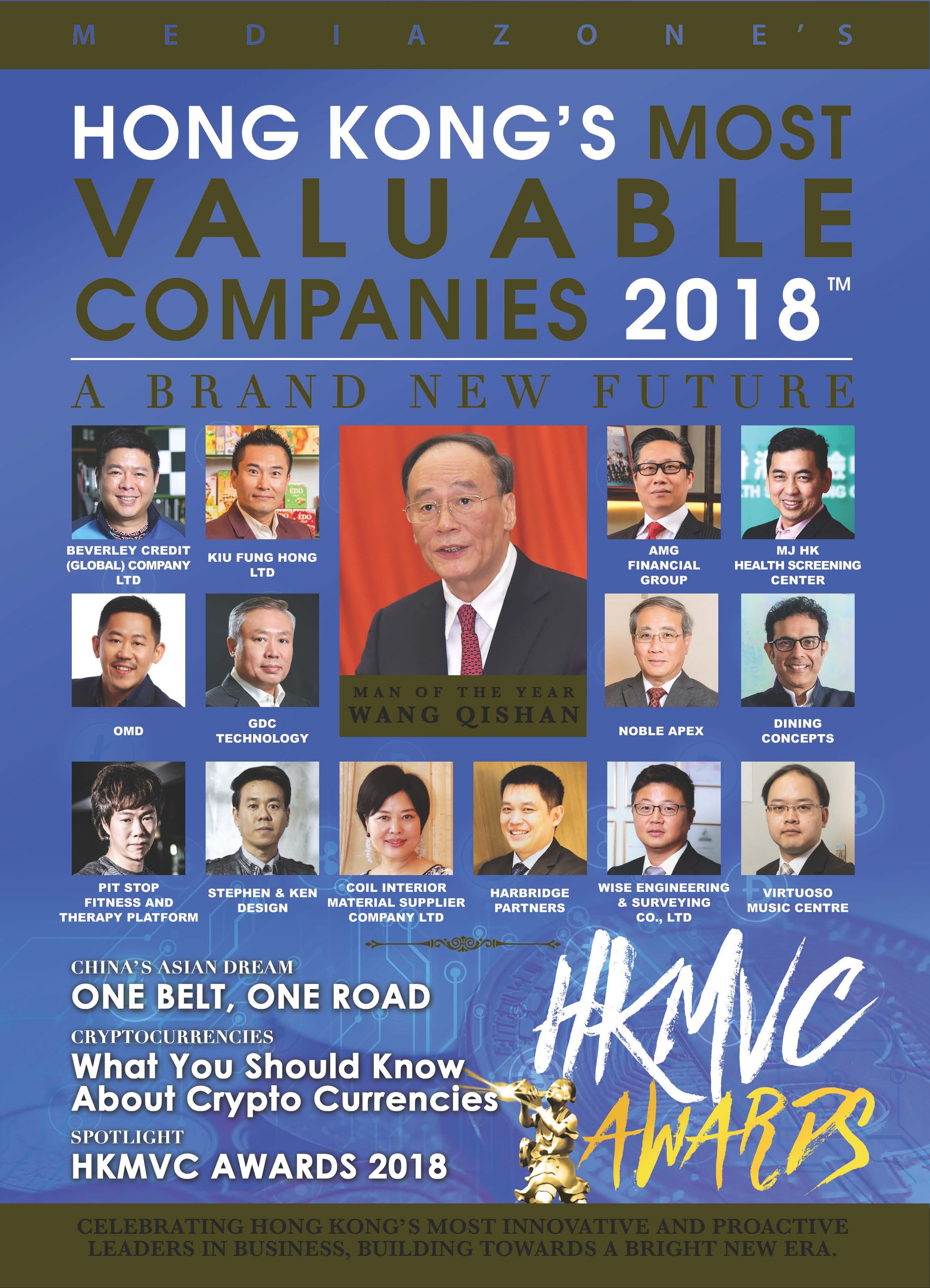

Noble Apex Advisors Ltd. is just awarded one of Hong Kong's Most Valuable Companies 2018 in January this year. The company is proud and excited to get this award from the Mediazone Group for the tenth consecutive years. Our Managing Director, Dr MF Chan, is invited as one of the figures on the magazine cover together with Vice President of the People's Republic of China Wang Qishan etc.

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "2018 Hope For The Best, Prepare For The Worst", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "How to invest around Chinese 'gray rhino' risk?", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "EU: Economy Restart", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "When Bulls Are Stronger Than Bears", contains updated information in the investment market. Don't miss this valuable reading experience!

We are pleased to announce Noble Apex Advisors Ltd. was conferred the honor of "15 Years Plus Caring Company" by The Hong Kong Council of Social Services (HKCSS). The Caring Company Scheme aims at building a cohesive society by promoting strategic partnership among businesses and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment.

The recognition ceremony took place at Hong Kong Convention and Exhibition Centre on 10 Mar 2017. This honor is the recognition of our commitment in Volunteering, Giving, Mentoring, Employing the Vulnerable, Caring for the Employees and Caring for the Environment for the past 15 years. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society in the future.

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "Trump’s Hope and Fear", contains updated information in the investment market. Don't miss this valuable reading experience!

Noble Apex Advisors Ltd. is just awarded one of Hong Kong's Most Valuable Companies 2017 in January this year. The company is proud and excited to get this award from the Mediazone Group for the tenth consecutive years. Our Managing Director, Dr MF Chan, is invited as one of the figures on the magazine cover together with Vice President of the People's Republic of China Li Yuan Chao etc.

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "The Rise Of New Economy Sectors", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "After ZERO Interest Rate", contains updated information in the investment market. Don't miss this valuable reading experience!

We are pleased to announce Noble Apex Advisors Ltd. was conferred the honor of "10 Years Plus Caring Company" by The Hong Kong Council of Social Services (HKCSS). The Caring Company Scheme aims at building a cohesive society by promoting strategic partnership among businesses and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment.

The recognition ceremony took place at Hong Kong Convention and Exhibition Centre on 10 May 2016. This honor is the recognition of our commitment in Volunteering, Giving, Mentoring, Employing the Vulnerable, Caring for the Employees and Caring for the Environment for the past 14years. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society in the future.

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled "Silver Economy: Future Growth Generators", contains updated information in the investment market. Don't miss this valuable reading experience!

Noble Apex Advisors Ltd. is just awarded one of Hong Kong's Most Valuable Companies 2016 in January this year. The company is proud and excited to get this award from the Mediazone Group for the ninth consecutive years. Our Managing Director, Dr MF Chan, is invited as one of the figures on the magazine cover together with President of the People's Republic of China Xi JinPing, etc.

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "Bright ideas for structural growth", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled "Climbing Wall of Worries", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled "China's Great Transformation", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled "Dancing Elephant Menacing Dragon: The Rise of China and India", contains updated information in the investment market. Don't miss this valuable reading experience!

We are pleased to announce Noble Apex Advisors Ltd. was conferred the honor of " 10 Years Plus Caring Company" by The Hong Kong Council of Social Services (HKCSS). The Caring Company Scheme aims at building a cohesive society by promoting strategic partnership among businesses and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment.

The recognition ceremony took place at Hong Kong Convention and Exhibition Centre on 25 March 2015. This honor is the recognition of our commitment in Volunteering, Giving, Mentoring, Employing the Vulnerable, Caring for the Employees and Caring for the Environment for the past 13years. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society in the future.

Noble Apex Advisors Ltd. is just awarded one of Hong Kong's Most Valuable Companies 2015 in January this year. The company is proud and excited to get this award from the Mediazone Group for the eighth consecutive years. Our Managing Director, Dr MF Chan, is invited as one of the figures on the magazine cover together with Premier of the State Council of the People's Republic of China Li KeQiang etc.

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled " Profiting From a Stronger Dollar", contains updated information in the investment market.

Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "Shanghai-HK Stock Connect Starts and Beyond", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled "The Best Ways to Invest in Europe's Recovery", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "What Yellen's Fed Means for Investors?", contains updated information in the investment market. Don't miss this valuable reading experience!

We are pleased to announce Noble Apex Advisors Ltd. was conferred the honor of " 10 Years Plus Caring Company" by The Hong Kong Council of Social Services (HKCSS). The Caring Company Scheme aims at building a cohesive society by promoting strategic partnership among businesses and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment.

The recognition ceremony took place at Hong Kong Convention and Exhibition Centre on 28 February 2014. There are only few companies being awarded for 10 years Plus and Nobel Apex is one of them. This honor is the recognition of our commitment in Volunteering, Giving, Mentoring, Employing the Vulnerable, Caring for the Employees and Caring for the Environment for the past 12years. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society in the future.

Noble Apex Advisors Ltd. is just awarded one of Hong Kong's Most Valuable Companies 2014 in January this year. The company is proud and excited to get this award from the Mediazone Group for the seventh consecutive years. Our Managing Director, Dr MF Chan, is invited as one of the figures on the magazine cover together with President of the People's Republic of China Xi JinPing etc.

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "2014 Keep the Stock Market Party Going", contains updated information in the investment market. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "Likonomics' Road to Deeper Reform", contains updated information in the investment market. Don't miss this valuable reading experience!

Date: 3rd and 4th Oct 2013

Venue: MCL JP Cinema, Causeway Bay

In celebrating Noble Apex’s 15th anniversary, the Noble Apex 15th Anniversary Gala Movie Night was organized for our valued clients on 3rd and 4th Oct 2013 at MCL JP Cinema in Causeway Bay. Over 700 guests attended and enjoyed the latest Hollywood movie “Gravity 3D” with us. Our Managing Director Mr. MF Chan expressed his gratitude towards clients and shared our happiness by presenting the prize of Noble Apex 15th Anniversary Lucky Draw to the winner.

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "Developed World Five Years After Crisis", contains updated information in the investment market. Don't miss this valuable reading experience!

2013Q2Noble Apex Quarterly Newsletter

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "Death of Commodity Super Cycle? Not Quite", contains updated information in the investment market. Don't miss this valuable reading experience!

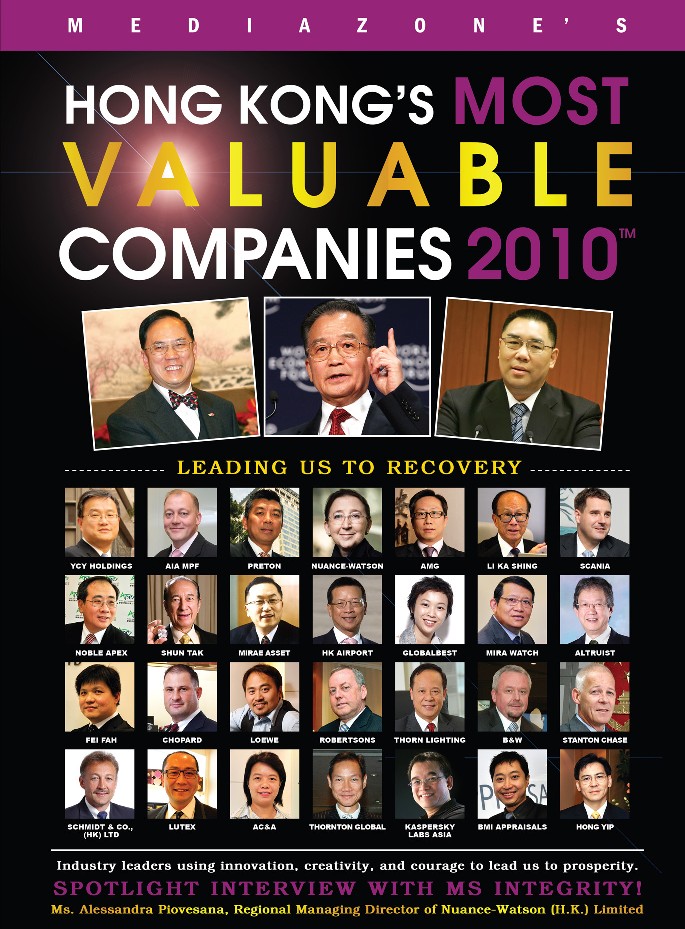

Noble Apex Advisors Ltd. is just awarded one of Hong Kong's Most Valuable Companies 2013 in January this year. The company is proud and excited to get this award from the Mediazone Group for the sixth consecutive years. Our Managing Director, Dr MF Chan, is invited as one of the figures on the magazine cover together with President of the People's Republic of China Xi JinPing, Chief Executive of Hong Kong C.Y Leung, etc.

The latest issue of the Noble Apex Quarterly Newsletter has just been published! This issue, titled "Paradigm Shift in Investment", contains updated information in the investment market. Don't miss this valuable reading experience!

Noble Apex contributes to the community actively, for example, in promoting appropriate financial education in the community and improving public financial management awareness. This year, Noble Apex has been awarded Financial Education Awards 2012 organized by The institute of Financial Planners of Hong Kong ( IFPHK ) and interviewed the concept of our financial education by Capital Magazine.

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled “Smart Investing With MPF ECA” , analyzes the investment strategy in year 2012. Don't miss this valuable reading experience!

Accredited Four Financial Education Awards

Noble Apex contributes to the community actively, for example, in promoting appropriate financial education in the community and improving public financial management awareness. In order to further contribute to our society, we have established Noble Apex Charity Fund and the Noble Apex Charity Ambassadors team. The Charity Fund is aimed to provide useful financial knowledge to the public, hence improving the quality of life; and to offer voluntary services as per request and cooperate with non-profit organizations to provide people in need with necessary resources.

This year, Noble Apex has been awarded Financial Education Awards 2012 organized by The institute of Financial Planners of Hong Kong ( IFPHK ). The Awards are - Award for Corporate Citizenship, Award for Best Financial Education Brand – Bronze, Award for Best Financial Education Program – Bronze and Award for Outstanding Community Partnership. This bears witness to our contribution to the society and affirmed our achievements for promoting financial education in the community. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society, now and in the future.

The Award presentation ceremony took place at Island Shangri-La Hong Kong on 20 September 2012 with the presence of Dr. Tong Chong-sze, the Secretary General of Hong Kong Examinations and Assessment Authority, as the officiating guest. IFPHK presented several great awards to the outstanding enterprises and affirmed our contribution of the public financial education. As a corporate social responsibility-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society in the future.

By means of its high flexibility in investment management strategy, Noble Apex provides clients with comprehensive investment portfolios which contribute to optimal rewards for customers even in an ever-changing investment environment, and thus earn the reliance and reputation from our valuable customers. Noble Apex Advisors Ltd. won the Portfolio Management (< 500 Seats) Gold Award in Advisor of the Year Awards 2012 organized by Benchmark magazine. Coupled with dual individual award wins from star financial advisors Stanley Chan Man-Chiu, Chief Sales Director at Noble Apex Wealth and a Category B Gold Award winner in BAYA 2012, and Roy Li, Financial Services Manager at Noble Apex Advisors and a Category B Silver Award winner in BAYA 2012, excellence and professionalism run consistently through the veins of the company.

We are pleased to announce Noble Apex Advisors Ltd. was conferred the honor of "10 Consecutive Years Caring Company" by The Hong Kong Council of Social Services (HKCSS) in recognition of our commitment in Volunteering, Giving, Mentoring, Employing the Vulnerable, Caring for the Employees and Caring for the Environment for the past 10 years.

The recognition ceremony took place on 3 May 2012 with the presence of Mr. Ambrose Lee Siu kwong, IDSM, JP, Secretary for Security of HKSAR as the officiating guest. The Caring Company Scheme aims at building a cohesive society by promoting strategic partnership among businesses and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment. There are only few companies being awarded for 10 consecutive years and Nobel Apex is one of them. As a corporate social responsiblity-committed corporation, Noble Apex keeps striving to use its expertise and resources to maximize the benefits of society in the future.

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled “China Wants Quality Growth” , analyzes the investment strategy in year 2012. Don't miss this valuable reading experience!

Noble Apex Advisors Ltd. is just awarded one of Hong Kong's Most Valuable Companies 2012 in January this year. The company is proud and excited to get this award from the Mediazone Group for the fifth consecutive years. Our Managing Director, Dr MF Chan, is invited as one of the figures on the magazine cover together with the Premier of the People's Republic of China Wen Jiabao & Hong Kong Entrepreneur Li Ka Shing, etc.

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled “The Power of the High Dividend Stocks” , analyzes the investment strategy in year 2012. Don't miss this valuable reading experience!

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled “No double-dip recession but Europe a worry”, discusses the possibility on double-dip recession in US and the latest asset allocation strategy . Don't miss this valuable reading experience!

Taking place in JW Marriott Hotel Hong Kong, the awards gala dinner of The Benchmark Advisor Of the Year Awards 2011 has successfully completed at 9 September,2011. Noble Apex Advisors Ltd. has been accredited with five awards, showing its pioneer position amongst its peers. Manton Wai, The Senior Financial Service Manager at Noble Apex, was awarded the Gold Trophy at Benchmark’s Advisor of the years Category B and The Best Financial Plan Award with his outperformance. Tramy Heung, The Senior Analyst of Research and Asset Management at Noble Apex, was the winner of Silver Trophy for Category B and The Best Investment Plan Award. While Ivan Ng, The Associate Director at Noble Apex was also the winner of Silver Trophy for Category B, proving the impressive strength of our professionals.

Date: 28th August 2011

Program Title: Hottest News of The Week

Interviewee: Ms Connie Sin, Associate Director, Noble Apex

Content: Discussions on iBond

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled “Emerging Market Inflation May Be Peaking” , discusses the outlook on Emerging Market Inflation. Don't miss this valuable reading experience!

Interview by Economic Observer

Date: 11th June 2011

Interviewee: Dr Chan Mou Fung, Managing Director, Noble Apex

Content: “Mini QFII” ready to take flight; Take advantage on retail fund

Please review the program at the link below:

http://www.eeo.com.cn/2011/0611/203566.shtml

We are pleased to announce our accreditation of the Caring Company Logo by the Hong Kong Council of Social Service for 9 consecutive years (2002 – 2011). Noble Apex is awarded in all 6 areas - Volunteering, Giving, Mentoring, Employing the Vulnerable, Caring for the Employees and Caring for the Environment. The recognition ceremony took place on 19 April 2011 with the presence of Mr. John Tsang, GBM, JP, Financial Secretary of HKSAR as the officiating guest.

The Caring Company Scheme aims at building a cohesive society by promoting strategic partnership among businesses and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment. There are 2,217 companies being awarded the Caring Company Logo this year, with a few companies being awarded for 9 consecutive years including Noble Apex.

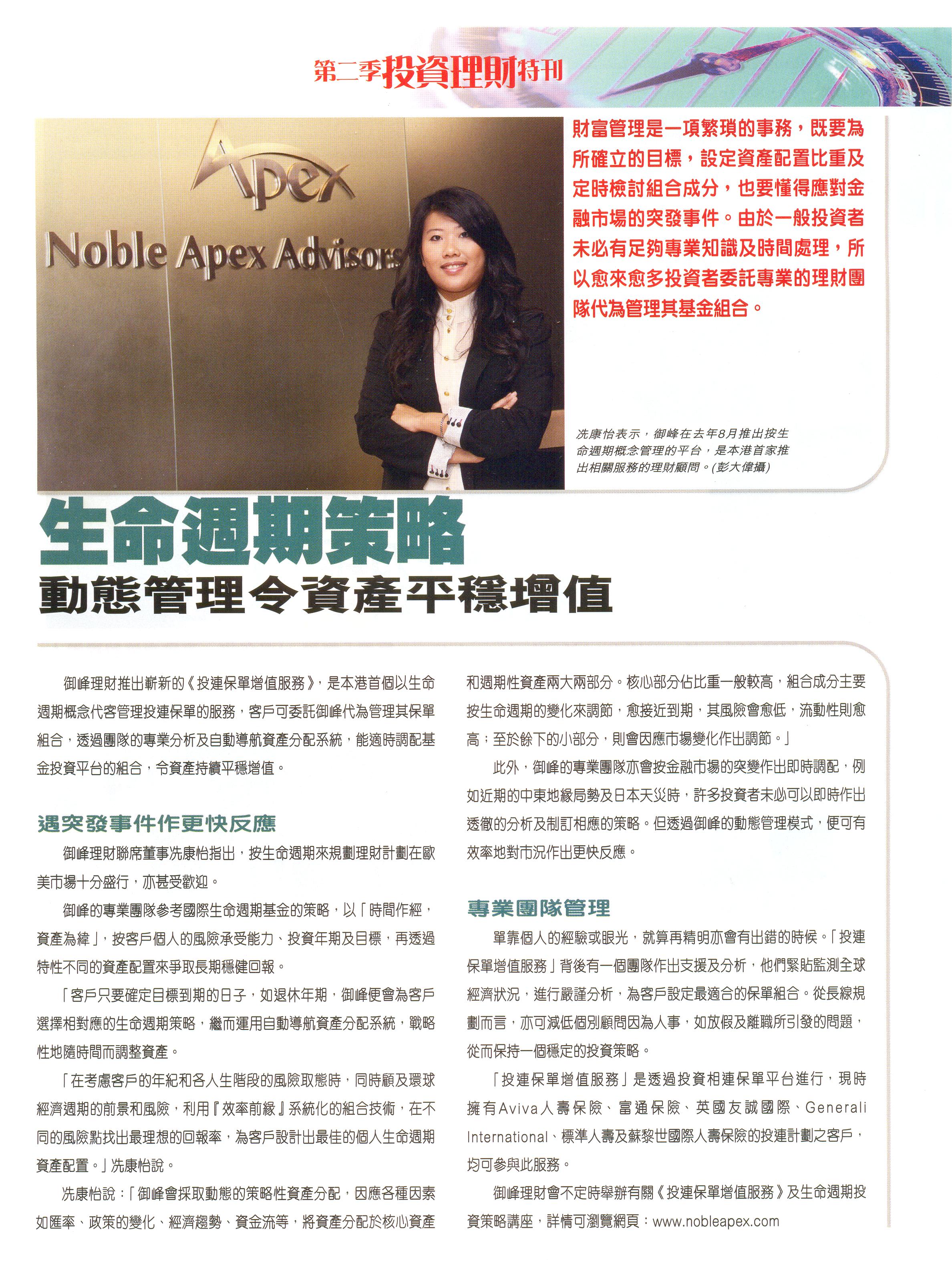

Date: 18th April 2011

Interviewee: Ms Connie Sin, Associate Director, Noble Apex

Section: Fund Investment

Content: Noble Apex “Ilas Value-Added Service”– Attain Stable Growth by Professional Management

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled “Implications of The World’s Aging Populations”, analyzes the investment strategy under the world’s aging populations. Don't miss this valuable reading experience!

Date: 29th March 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: An optimistic economy: South Korea, & The radiation crisis in Japan

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 22nd March 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis on North Korea economy

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 15th March 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis on the use of global energy after earthquake in Japan

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 8th March 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis on Japan and Korea Economy

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 1st March 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Contradictory actions of Indonesia and India central bank

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 8th March 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The economic impact of rising oil prices

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 15th March 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The impact of global capital flows & Issues on global inflation and the U.S. Treasury

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 25th January 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Likely to enter the global inflation era

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Noble Apex Advisors Ltd. is just awarded one of Hong Kong's Most Valuable Companies 2011 in January this year. The company is proud and excited to get this award from the Mediazone Group for the fourth consecutive years. Our Managing Director, Dr MF Chan, is invited as one of the figures on the magazine cover together with President of the People's Republic of China Hu JinTao, Chief Executive of Hong Kong Donald Tsang Yam Kuen & Hong Kong Entrepreneur Li Ka Shing, etc.

Date: 18th January 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The strong rebound in euro & Analysis on property tax in China

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 11th January 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: European Union economic issue

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled "Outlook for 2011", focuses on the global economic trend and investment strategy for 2011. Don't miss this valuable reading experience!

Date: 4th January 2011 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis on the success of facebook

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 28th December 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The increase on interest rate in China & The outlook for China and US in 2011

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 21st December 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The acceleration of U.S. economic growth in the first half of next year

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 10th December 2010

Interviewee: Tony Chow, Assistant General Manager, Noble Apex

Section: Financial News

Content: Enjoy double appreciation by purchasing gold with RMB

Date: 30rd November 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Gold ETF & The sales on Thanksgiving Day

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 23rd November 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Hong Kong property market, China tightening monetary policy & Conflict between North and South Korea

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 10th November 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Doubt of the power and influence on QE2

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 2nd November 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The feasibility and possibility of QE II

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 26th October 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The performance of agricultural stock in 2010 Q4 and 2011 Q1

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 12th October 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Real Estate Market in Mainland & The Business development of banks in Mainland

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled The Optimal Strategy for Retirement Planning: Life Cycle Investment, focuses on the retirement financial planning strategy. Don't miss this valuable reading experience!

Date: 5th October 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Comparison on the economic structure between China and India & Will communism recover in United States?

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 28th September 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis on Chongqing property market & U.S. macro-economic analysis

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 21st September 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: To view China's development from Chengdu

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 14th September 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Macro analysis on Hong Kong stocks, The trend of A shares & Analysis on stocks of insurance sector

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 7th September 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis on Hong Kong property market & Obama’s rescue policy

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 31st August 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Concerns on migration of Hong Kong Business Corporation & Economic quagmire of United States and Japan

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 25th August 2010

Interviewee: Tramy Heung, Analyst, Noble Apex

Section: Financial News

Content: Analysis on financial planning cases

Date: 24th August 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Hostage incident in Philippines & Discussions on U.S. Treasury in depth

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 17th August 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 10th August 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: News on China share and property market, & Is the United States QE II coming?

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 3rd August 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Insight on HSBC and the financial corporation in U.S. & Influence on U.S. population problem

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 27th July 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: How economics help our community & The ethics issue of Octopus

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 20th July 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Influence on U.S. population problem & Relationship between U.S. saving rate and Dow Jones Index.

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 20th July 2010

Interviewee: Tony Chow, Assistant General Manager, Noble Apex

Section: Financial News

Content: Analysis on financial planning cases

Date: 13th July 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: U.S. population problem is severe

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled US and Europe Recovery Flashes Red, focuses on the analysis on economy of US and Europe. Don't miss the chance to read our newsletter with rich contents!

Date: 6th July 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: US economy faces double dip & Global Index rebound is illusion

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 29th June 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Invest in silver better than gold? & Past performance on IPO shares of banks in China

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 22nd June 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The Impact of raising RMB interest rate on China stock market & Domestic competition is fierce in China

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 15th June 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Is the increase in labour cost a disaster or blessing to China economy? & The influence on new loans on the banking system in China

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 8th June 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The influences of wage increase on corporate profit and domestic demand & Discussions on Hungary debt issue

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

An exciting Client Incentive Program for 2010 is now launched! Noble Apex will organize a Film Show in July as a token of thanks for your support. For arrangements and details of the event, please contact your designated Noble Apex consultant or call our customer services hotline at (852) 2230 1000.

Date: 23rd March 2010

Interviewee: Dr MF Chan, Managing Director, Noble Apex

Content: Accomplishment of Hong Kong's Most Valuable Companies Award for three consecutive years & how Noble Apex adds value to clients in China

Please review the interview at the link below:

http://www.mediazone.com.hk/

Date: 25th May 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Spain's banking crisis & Ways to resolve the debt of Greece

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 18th May 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Discussion on debt crisis in Europe & Reasons for A shares drop recently

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 12th May 2010

Section: Financial News

Interviewee: Daniel So, Researcher, Noble Apex

Content: Recommendation on stocks

Date: 11th May 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Discussions on European central bank bailout policy & Analysis on European union system

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 4th May 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Has Australia economy truly recovered? & Is China raised in bank reserve requirements a prelude to raise the interest rate?

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 27th April 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The reasons for U.S. stocks plunge deeply & Investigation on the Euro debt structure issue

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 22nd April 2010

Time: 3:50 pm

Program Title: Trading Hour

Interviewee: Daniel So, Portfolio Manager, Noble Apex

Content: Property market cooling measures on HK & Chinese stock markets & Recommendation on favoured sectors

Date: 20th April 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis on US stock market & Analysis on the incident of Goldman Sachs sued by SEC

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 13th April 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis on Renminbi appreciation and its free exchange policy

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

The latest issue of the Noble Apex Quarterly Newsletter has just been published!

This issue, titled "Year of the Crouching Tiger", focuses on the diversified analysis on the investment strategy in the year of tiger. Don't miss the chance to read our newsletter with rich contents!

We are pleased to announce our accreditation of the Caring Company Logo by the Hong Kong Council of Social Service for 8 consecutive years (2002 – 2010). Noble Apex is awarded in all 6 areas - Volunteering, Giving, Mentoring, Employing the Vulnerable, Caring for the Employees and Caring for the Environment. The recognition ceremony took place on 25 March 2010 with the presence of Mr. Henry Tang, GBM, GBS, JP, Chief Secretary for Administration of HKSAR as the officiating guest.

The Caring Company Scheme aims at building a cohesive society by promoting strategic partnership among businesses and social service partners and inspiring corporate social responsibility through caring for the community, employees and the environment. There are 2,082 companies being awarded the Caring Company Logo this year, with a few companies being awarded for 8 consecutive years including Noble Apex.

Date: 6th April 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Pressure on global inflation & analysis of Shanghai's economy

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 30th March 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis on the U.S. stock market and enterprises

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 26th March 2010 (Friday)

Time: 12:30pm – 2:00pm

Venue: HK Medical Association, 5/F, Duke of Windsor Social Service Building, Wanchai

The Luncheon was hosted by the Hong Kong Council of Social Service to facilitate discussion among the Patron’s Club members and the delegation from the Ministry of Civil Affairs of PRC. Around one hundred guests participated in this event, including 2 representatives from Noble Apex.

At the luncheon, Mr Wang Zhenyao, Director General, Department of Social Welfare and Promotion of Charities, Ministry of Civil Affairs introduced to all the guests the NGOs and community services in the Mainland. The Patron’s Club members were keen on sharing the social services and charity works organized by their corporations with the officials from the Ministry. The event ended with a great success, hoping that we can help build a harmonious community in China by providing charity services to the needy.

Date: 22nd March 2010

Section: Cover Story

Interviewee: Wallace Yuen, Director of China Business, Noble Apex

Content: Benefits from CEPA to Hong Kong financial services industry

Date: 18th March 2010

Section: Financial News

Interviewee: Daniel So, Researcher, Noble Apex

Content: ETF Investment

Date: 16th March 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Four key elements in financial market 2010 & the reasonable range of Hong Kong Stock Index in 2010

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 9th March 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis of the US Stock Market and China's Policy Tone at the NPC & CPPCC meetings

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 2nd March 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The trend of Hang Seng Index and long-term investment after Financial Tsunami

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 23th February 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Is US stepping towards exit? Which mortgage plan is better, HIBOR or Prime Rate?

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 18th February 2010

Time: 3:50 p.m.

Program Title: Trading Hour

Interviewee: Daniel So, Portfolio Manager, Noble Apex

Content: Outlook of US Monetary Policy and Stock Market

Noble Apex Advisors Ltd. is just awarded one of Hong Kong's Most Valuable Companies 2010 in January this year. The company is proud and excited to get this award from the Mediazone Group for three consecutive years. Our Managing Director, Dr MF Chan, is invited as one of the figures on the magazine cover together with Premier Wen Jiabao, Chief Executive of Hong Kong Donald Tsang Yam Kuen and Chief Executive of Macau Fernando Chui Sai On, etc.

Date: 9th February 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Exit strategy or normalization of interest rate and the Euro zone collapses?

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 4th February 2010

Time: 10am

Program Title: Trading Hour

Interviewee: Daniel So, Portfolio Manager, Noble Apex

Content: Outlook of the Hong Kong Stock Market

Date: 2nd February 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: HSBC's investment in China, Reserve Bank of Australia keeps interest rates unchanged

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 29th - 30th January 2010

Time: 2:00pm – 5:00pm (29th January), 10:00am - 5:00pm (30th January)

Venue: Sydney Westin Hotel

Date: 26th January 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: China's new bank lending, the US bank reform and the issue of Euro

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 22nd - 23rd January 2010

Time: 2:00pm – 5:00pm (22nd January), 10:00am - 5:00pm (23rd January)

Venue: Westin Stamford Hotel, Singapore

Date: 19th January 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: The acquisition of Cadbury by Kraft and JAL's restructuring

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 15th - 16th January 2010

Time: 2:00pm – 5:00pm (15th January), 10:00am - 5:00pm (16th January)

Venue: Grand Hyatt, Shenzhen, PRC

Date: 12th January 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis of the China loan issue and the property markets of China and the States

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

Date: 8th - 9th January 2010

Time: 2:00pm – 5:00pm (8th January), 10:00am - 5:00pm (9th January)

Venue: Westin, Taipei

Speakers:

Ms Mancy Law, PMFT Consultancy Ltd

Mr Hsin Chiao, Head of Equity Derivatives & PIP Sales, Taiwan, RBS

Dr MF Chan, Managing Director of Noble Apex and President of Caishang Wealth Managers

Mr David Luk, Investment Counselor Director, ING Bank

Mr Royan Lam, Head of Retail, Macquarie Equities (Asia) Ltd

Mr Raymond Hui, Director of Treasury & Derivatives Trading and Head of Treasury (China), Societe Generale

Mr Alex Ko, Institutional Sales, ICBC International

Mr Eric Leung, Institutional Sales, ICBC International

Mr Victor Ho, Head of FX, MF Global

Date: 5th January 2010 (Every Tuesday)

Time: 11:30pm

Program Title: Financial News

Interviewee: John Lui, Senior Director, Noble Apex

Content: Analysis of US dollar, US bond, FX and gold market

Please review the program at the link below:

http://www.hkreporter.com/myradio/channel_list.php?channelid=282

The latest issue of the Noble Apex Quarterly Newsletter has just been published !

This issue, entitled as “Global Investment Outlook 2010 Four Most Promising Sectors” contains updated information in the investment market. Don’t miss this valuable reading experience!

Date︰29th December 2009

Time︰10am

Program Title︰Trading Hour

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰Hong Kong Land Auction, Outlook on H-share & Review of 2009

Date︰3rd December 2009

Time︰10am

Program Title︰Trading Hour

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰Dubai Crisis, economies in US & Europe

Date: 28th November 2009 (Saturday)

Time: 9:00am – 12:45pm

Venue: Hyatt Hotel, Bund Zone, Shanghai

Speakers:

Mr Patrick Tuohy, Principal Consultant, PMFT Consultancy Ltd

Mr Alex Fan, Head of Research, ICBC International

Mr Alex Ko, Institutional Sales, ICBC International

Mr Eric Leung, Institutional Sales, ICBC International

Mr Raymond Hui, Director of Treasury & Derivatives Trading and Head of Treasury (China), Societe Generale

Dr MF Chan, Managing Director of Noble Apex and President of Caishang Wealth Managers

Mr Russell Beattie, Director & Head, Listed Futures and Global Market Equities, Asia Institutional Client Group, Deutsche Bank AG

Mr David Luk, Investment Counselor Director, ING Bank

Mr Victor Ho, Head of FX, MF Global

Mr David Loo, Director & Senior Investment Counselor, Investment, Asia Pacific, Citigroup

Date︰3rd November 2009

Time︰10am

Program Title︰Trading Hour

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰Impacts on Market by US and China Exit Strategy

Date: 25th September 2009

Time: 3pm

Program: News Report & Financial News

Interviewee: Tony Chow, Assistant General Manager, Noble Apex

Content: New Regulatory Policies Implemented by HKSFC

Date︰7th September 2009

Time︰10am

Program Title︰Trading Hour

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰Impacts on HK & China Market by Expanding QFII

Date︰10th August 2009

Time︰2:40pm

Program Title︰Trading Hour

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰ US Interest Rate and Stock Market Preview

Date: 5th August 2009

Section: News - Daily Magazine

Interviewee: Tony Chow, Assistant General Manager, Noble Apex

Content: Investment Seminar

Date: 23rd July 2009

Section: Financial News

Interviewee: Daniel So, Researcher, Noble Apex

Content: China Funds

Date: 20th July 2009

Section: Financial News

Interviewee: Daniel So, Researcher, Noble Apex

Content: Financial Planning for Retirement and Mortgage

Date︰20th July 2009

Time︰12 noon

Program Title︰Trading Hour

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰ US & HK Stock Market

We will confirm the seats with participants by email or phone on or before 3rd July 2009. For enquiry, please contact us at 2230 1000 or marketing@nobleapex.com

Date︰29th June 2009

Time︰10am

Program Title︰Trading Hour

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰ IPO and Rights Issue Trend in Hong Kong, the US and Europe

Date: 25th June 2009

Time: 3pm

Program: News Report & Financial News

Interviewee: Tony Chow, Assistant General Manager, Noble Apex

Content: Merrill Lynch - Capgemini Annual World Wealth Report

Date: 24th June 2009

Time: 11am

Program: News Report

Interviewee: Daniel So, Researcher, Noble Apex

Content: US Interest Rate and Stock Market

Date: 15th May 2009

Time: 4:00pm – 5:00pm

Interviewee: MF Chan, Managing Director, Noble Apex

Content: Future Financial Co-operation between Mainland China and Taiwan

Date: 6th April 2009

Time: 12pm - 1pm

Program: News Report

Interviewee: John Lui, Senior Director, Noble Apex

Content: A-shares of China Market and US Market

We are pleased to announce our accreditation of the Caring Company Logo by the Hong Kong Council of Social Service (HKCSS) for 7 consecutive years (2002 – 2009). Noble Apex is awarded in 4 areas namely Volunteering, Employment Friendly, Mentoring and Giving. The recognition ceremony took place on 10 February, 2009 with the presence of Mr. John Tsang, JP, Financial Secretary of HKSAR as the officiating guest.

The Caring Company Scheme aims at building a caring community spirit through cultivating corporate citizenship and strategic partnership among the business, public and non-profit organizations. There are 1,604 companies being awarded the Caring Company Logo this year, with only 291 companies being awarded for over 5 consecutive years, including Noble Apex.

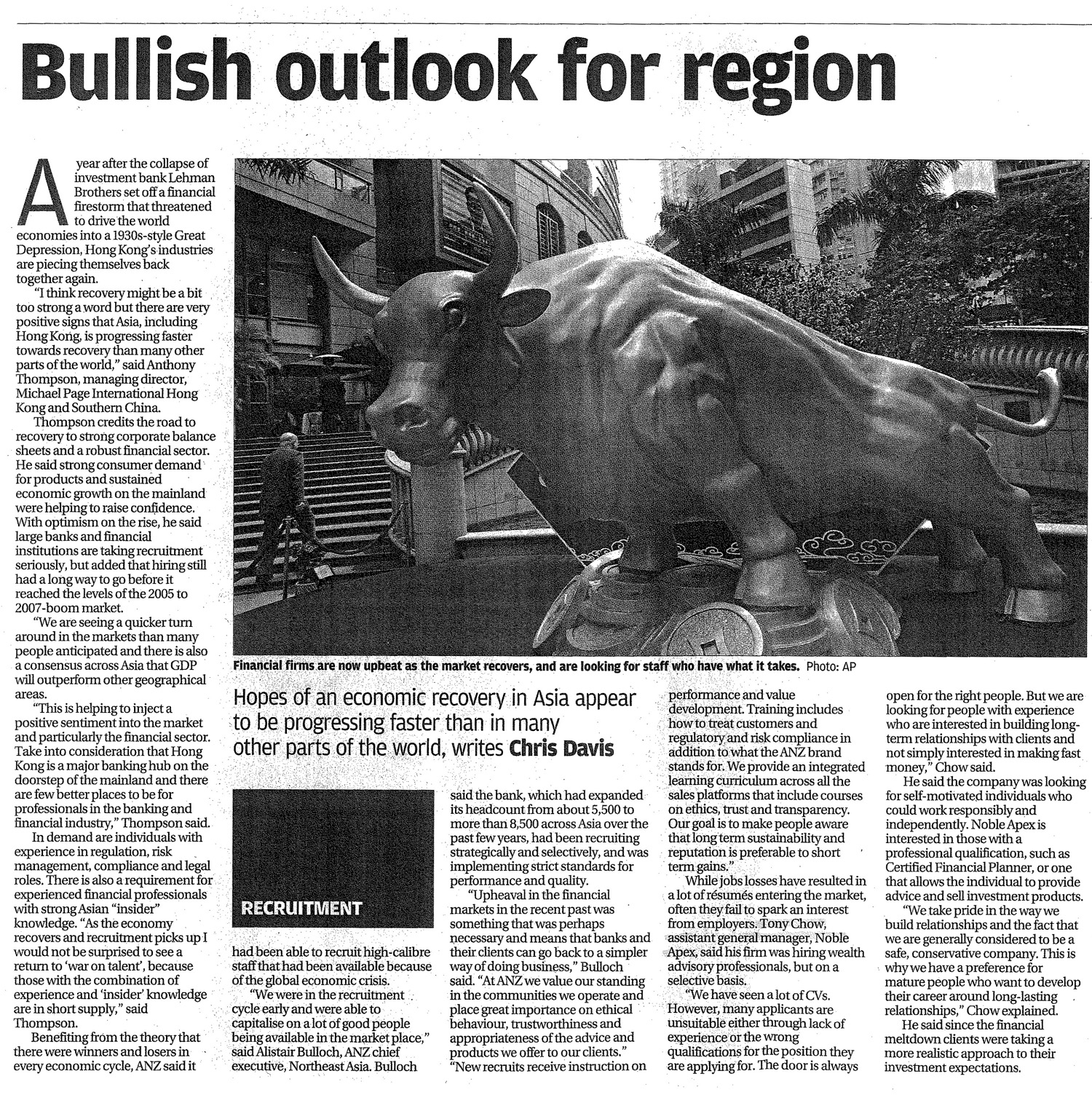

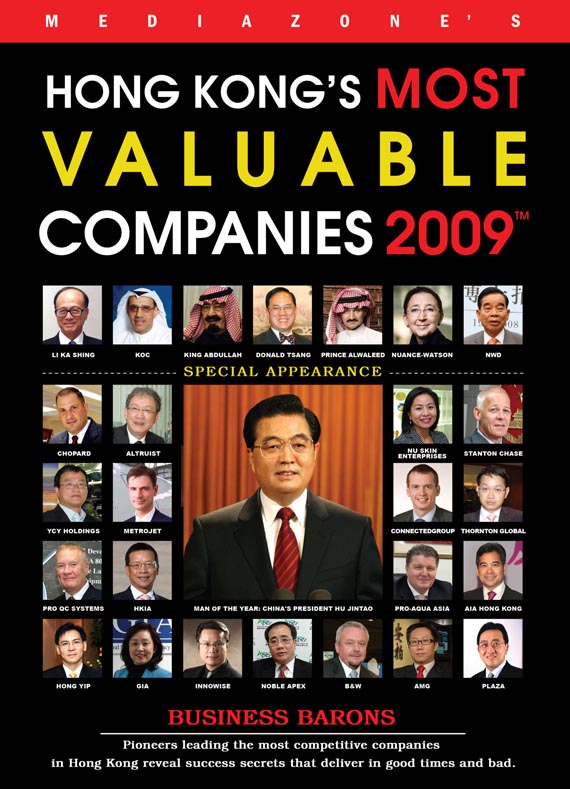

Noble Apex Advisors Ltd. is recently awarded as one of Hong Kong’s Most Valuable Companies 2009 by the Mediazone Group! Our Managing Director, MF Chan, was invited for an interview, with his photo being put on the cover, together with photos of other people such as President Hu Jintao, Chief Executive Donald Tsang, Hong Kong Entrepreneur Li Ka Shing, etc.

Noble Apex Referral Program 2009 has been launched. Successful referees are eligible to cash coupons. Don't miss this chance!

Date︰12th December 2008

Time︰12:20pm

Program Title︰Trading Hour

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰Investment Strategies in 2009

中國近代鴻儒胡適曾說過:「今天準備明天,這是真穩健;生時準備死時,這是真曠達;父母為兒女準備,這是真慈愛;不能做到這三點,不能稱為現代人!」在胡適生活的年代,人們並沒有財務規劃的概念。今天假如胡適仍然在生,或許他會把結語改為:「不做財務規劃,不能稱為現代人!」人生各階段有不同的理財需要,預早計劃,妥善理財,方有璀璨未來。

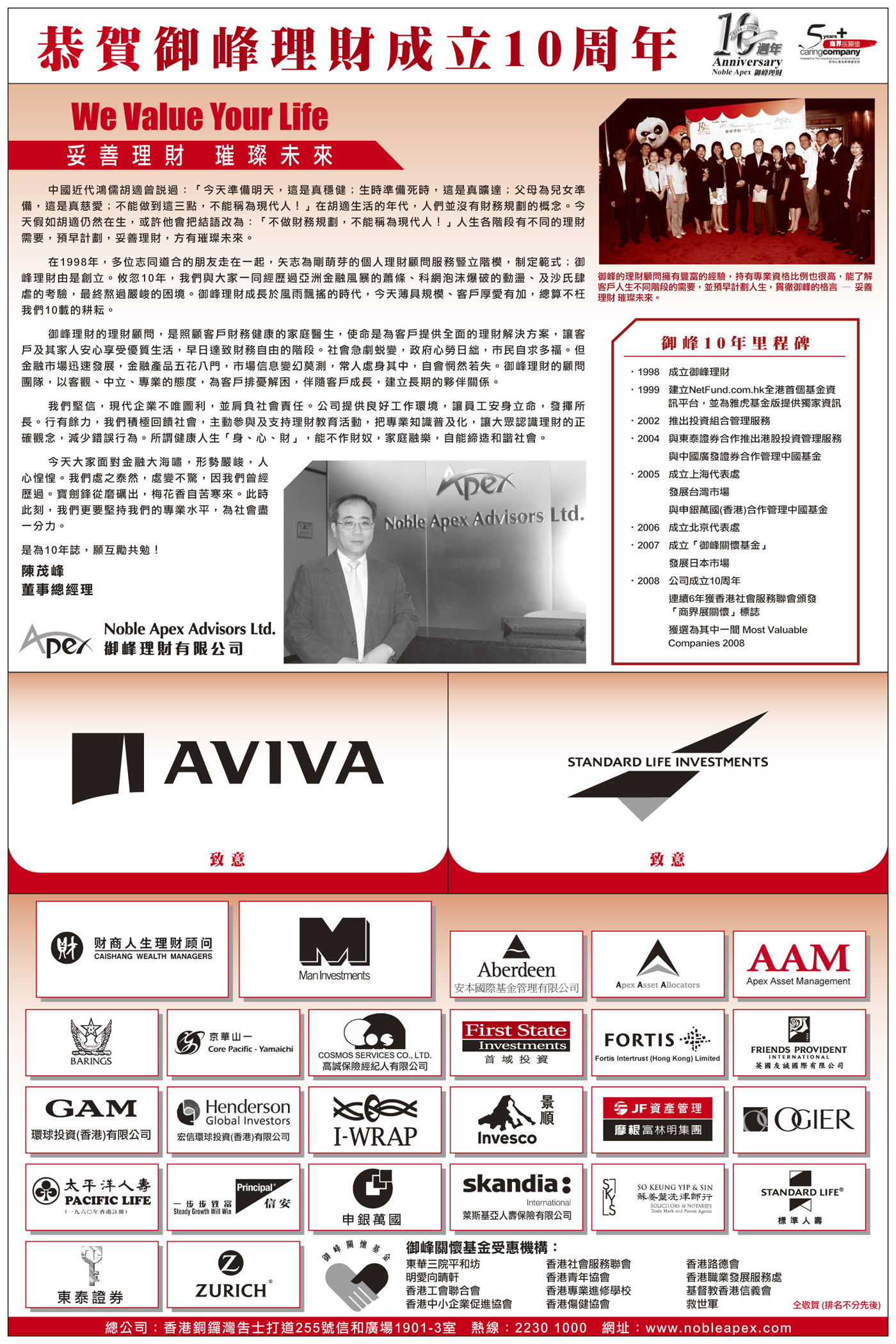

在1998年,多位志同道合的朋友走在一起,矢志為剛萌芽的個人理財顧問服務豎立階模,制定範式;御峰理財由是創立。攸忽十年,我們與大家一同經歷過亞洲金融風暴的蕭條、科網泡沫爆破的動盪、及沙氏肆虐的考驗,最終熬過嚴峻的困境。御峰理財成長於風雨飄搖的時代,今天薄具規模、客戶厚愛有加,總算不枉我們十載的耕耘。

御峰理財的理財顧問,是照顧客戶財務健康的家庭醫生,使命是為客戶提供全面的理財解決方案,讓客戶及其家人安心享受優質生活,早日達致財務自由的階段。社會急劇蛻變,政府心勞日絀,巿民自求多福。但金融市場迅速發展,金融產品五花八門,市場信息變幻莫測,常人處身其中,自會惘然若失。御峰理財的顧問團隊,以客觀、中立、專業的態度,為客戶排憂解困,伴隨客戶成長,建立長期的夥伴關係。

我們堅信,現代企業不唯圖利,亦肩負社會責任。公司提供良好工作環境,讓員工安身立命,發揮所長。行有餘力,我們積極回饋社會,主動參與及支持理財教育活動,把專業知識普及化,讓大眾認識理財的正確觀念,減少錯誤行為。所謂健康人生「身、心、財」,能不作財奴,家庭融樂,自能締造和諧社會。

今天大家面對金融大海嘯,形勢嚴峻,人心惶惶。我們處之泰然,處變不驚,因我們曾經歷過。寶劍鋒從磨礪出,梅花香自苦寒來。此時此刻,我們更要堅持我們的專業水平,為社會盡一分力。

是為十年誌,願互勵共勉!

陳茂峰

董事總經理

Date:

11th November 2008 (Tuesday) 7pm - 8pm OR

17th November 2008 (Monday) 7pm - 8pm OR

20th November 2008 (Thursday) 6pm - 7pm OR

20th November 2008 (Thursday) 7pm - 8pm OR

Venue: 19/F, Sino Plaza, 255 Gloucester Road, Causeway Bay

Speaker: Henry Tong, Man Investments

All Seminars are full. Thanks for participation.

Date: 2nd Nov 2008 (Sunday)

Time: 2:30pm - 4pm

Venue: The Hong Kong Polytechnic University

Guests:

Ms Christine Fang, Chief Executive, HKCSS

Mr Cheung Hing Wah, Assistant Director, Social Welfare Department

Mrs Victoria Kwok, Director, Social Services Department, The Salvation Army

Mr MF Chan, Managing Director, Noble Apex

Ms Cecillia Chow, Noble Apex Charity Ambassador

Ms Rita Chan, Noble Apex Charity Ambassador

Date: 28th October 2008

Section: Local News

Interviewee: MF Chan, Managing Director, Noble Apex

Content: Outlook of Hong Kong Stock Market

Date: 27th October 2008 (Monday)

Venue: The Church of Christ in China Shum Oi Church, Shek Kip Mei

Time: 7:30pm - 9:30pm

Participants: All interested parties

Fee: Free of Charge

Content: Investments in Financial Tsunami

Date: 25th October 2008

Venue: 3/F, Holiday Inn Golden Mile Hong Kong

Time: 2pm - 4pm

Participants: Ming Pao members

Content: Investments in Quarter 4

Date︰18th September 2008

Time︰12:15pm

Program Title︰Trading Hour

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰Investment Strategies in Financial Tsunami

As informed by UOB, Noble Apex Visa Platinum and Noble Apex Visa Infinite expired with effect from 1st September 2008, due to the fact that UOB terminated the credit card business in Hong Kong. All accumulated UNI$ earned under these two cards can be redeemed on or before 31st October 2008. Thanks for your support in Noble Apex and we will surely provide more benefits for clients in the future.

Date︰23rd August 2008

Coverage︰Features in Funds

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰New Emerging Markets

Date︰Every Thursday

Time︰9:25 pm

Program Title︰Wall Street Journal Report (華爾街快訊)

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰US & Europe market, commodities and currencies

Note: "Wall Street Journal Report" has been suspended since February 2009

Date︰28th July 2008

Time︰5pm

Program Title︰Financial Plaza (經濟脈搏)

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰Investment Strategies in Second Half 2008

Date︰25th July 2008

Time︰10am

Program Title︰Trading Hour 1 (交易時段)

Anchor︰Wong Hoi Tik

Interviewee︰Daniel So, Researcher, Noble Apex

Content︰Review of current market and outlook of individual industries and countries

Date:

29th June 2008

Venue:

Penthouse Ballroom, Hotel Miramar

Speakers:

Alex Lee, Executive Director, Noble Apex Advisors Ltd

Alex Tang, Director, Research, Core Pacific – Yamaichi

Philip Fok, Vice President, Intermediary Sales, JF Asset Management

Joyce Chan, Assistant Vice President, Distribution, Allianz Global Investors

More than 600 participants joined our seminar this time. They were deeply impressed by the Q & A and lucky draw sessions and the advice of four speakers about the investment opportunities in the current trendless market. With enthusiastic responses of the audience, the seminar ended with satisfaction.

To show our thankfulness towards the valued clients, the Noble Apex 10th Anniversary Reward Program is cordially launched for them. From now until 30th September 2008, customers are entitled to premium rewards upon successful subscription to fund products, saving plans or insurance plans through Noble Apex.

Rewards include:

2 Round-the-World Air Tickets on Cathay Pacific Airways

Sogo Gift Certificate

Park’N Shop Gift Certificate

Noble Apex 10th Anniversary Commemoration Red Wine

For details, please contact your Noble Apex consultant or call our hotline at 2230 1000.

Date: 23rd May 2008

Venue: MCL JP Cinema, Causeway Bay

In celebrating Noble Apex’s decennial anniversary, the Noble Apex 10th Anniversary Gala Movie Night was organized for our valued clients on 23rd May 2008 at MCL JP Cinema in Causeway Bay. Over 600 guests attended and enjoyed the latest Hollywood movie “Indiana Jones and The Kingdom of The Crystal Skull” with us. Our Managing Director Mr. MF Chan expressed his gratitude towards clients and shared our happiness by presenting them bottles of Noble Apex 10th Anniversary Commemoration Red Wine.

Date: 10th – 11th May, 2008

Venue: Hong Kong Convention and Exhibition Centre

Over 20 Noble Apex consultants participated in Investment Expo this year to provide professional advice for the visitors. As the highest and most brilliant booth among all exhibitors, our booth attracted hundreds of visitors approaching for financial information and services of Noble Apex. There were 20 visitors who won the “Noble Apex Fund Game” and were awarded bottles of red wine.